Houston, a bustling metropolis known for its diverse population and sprawling roadways, presents a unique landscape for car insurance. With its heavy traffic, unpredictable weather, and varying crime rates, understanding the nuances of car insurance in Houston is crucial for every driver. From navigating the legal requirements to finding the best coverage options, this guide delves into the intricacies of securing adequate car insurance in the Bayou City.

This exploration will cover the essential aspects of car insurance in Houston, including the types of coverage available, the factors influencing rates, and practical tips for finding the best deals. We’ll also shed light on the claims process and explore resources for drivers seeking assistance. By the end, you’ll be equipped with the knowledge and insights needed to navigate the car insurance landscape in Houston with confidence.

Car Insurance in Houston

Navigating the bustling streets of Houston requires more than just a valid driver’s license; it necessitates adequate car insurance to protect yourself and others in the event of an accident. Texas law mandates that all drivers carry liability insurance to cover damages caused to others, ensuring financial security in case of an unforeseen incident.

Legal Requirements for Car Insurance in Texas

Texas law requires all drivers to carry liability insurance to cover damages caused to others in an accident. This minimum coverage includes:

- Bodily Injury Liability: $30,000 per person, $60,000 per accident. This covers medical expenses, lost wages, and pain and suffering for injuries caused to other people in an accident.

- Property Damage Liability: $25,000 per accident. This covers damages to another person’s vehicle or property in an accident.

While these minimum coverage limits are legally required, they may not be sufficient to cover all potential costs in a serious accident. Consider purchasing higher coverage limits to ensure adequate financial protection.

Factors Influencing Car Insurance Rates in Houston

Several factors contribute to the variability of car insurance rates in Houston. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums.

- Traffic Congestion: Houston is notorious for its heavy traffic, increasing the likelihood of accidents. Insurance companies consider traffic congestion a significant risk factor, potentially leading to higher premiums.

- Weather Patterns: Houston’s humid climate and occasional severe weather events, such as hurricanes and heavy rain, can contribute to accidents and damage to vehicles. Insurance companies may factor these weather risks into their rate calculations.

- Crime Rates: Higher crime rates in certain areas can increase the risk of theft or vandalism, which can affect insurance premiums. Insurance companies may assess crime statistics when determining rates for specific neighborhoods.

Types of Car Insurance Coverage in Houston

Navigating the world of car insurance in Houston can feel overwhelming, especially with the diverse range of coverage options available. Understanding the different types of car insurance coverage and their implications is crucial for making informed decisions that align with your individual needs and budget.

Liability Coverage

Liability coverage is the most basic and often legally mandated type of car insurance. It protects you financially if you cause an accident that results in injuries or damage to another person’s property. Liability coverage typically consists of two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver and passengers involved in an accident caused by you.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle and any other property damaged in an accident caused by you.

The amount of liability coverage you need depends on factors such as the value of your assets and your risk tolerance. For instance, individuals with significant assets may choose higher liability limits to protect themselves from substantial financial losses in the event of a serious accident.

Collision Coverage

Collision coverage protects you from financial losses if your car is damaged in an accident, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance company covers the remaining costs.

Collision coverage is particularly beneficial for newer vehicles with higher value. For older vehicles, it may be more cost-effective to forego collision coverage, as the repair costs might exceed the vehicle’s actual cash value.

Comprehensive Coverage

Comprehensive coverage protects you from financial losses due to damages to your vehicle caused by events other than collisions, such as:

- Theft

- Vandalism

- Natural disasters

- Fire

This coverage is essential for vehicles with higher value or for drivers who live in areas prone to natural disasters or theft.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you in the event of an accident caused by a driver who is uninsured or has insufficient insurance to cover your losses. This coverage pays for your medical expenses, lost wages, and other damages.

- Uninsured Motorist Coverage (UM): This coverage applies when the other driver does not have any insurance.

- Underinsured Motorist Coverage (UIM): This coverage applies when the other driver’s insurance limits are not enough to cover your losses.

UM/UIM coverage is particularly important in areas with a high percentage of uninsured drivers.

Example Scenarios

- Scenario 1: Liability Coverage

You are driving in Houston and accidentally rear-end another vehicle. The other driver sustains injuries and their car is damaged. Your liability coverage will pay for their medical expenses and vehicle repairs. - Scenario 2: Collision Coverage

You are driving in Houston and your car is damaged in a collision with a parked vehicle. Even though you were at fault, your collision coverage will pay for the repairs to your vehicle. - Scenario 3: Comprehensive Coverage

You are driving in Houston and your car is damaged by a hailstorm. Your comprehensive coverage will pay for the repairs to your vehicle. - Scenario 4: UM/UIM Coverage

You are driving in Houston and are hit by an uninsured driver. Your UM/UIM coverage will pay for your medical expenses and other damages.

Factors Affecting Car Insurance Rates in Houston

Car insurance premiums in Houston, like elsewhere, are influenced by a multitude of factors. These factors are carefully assessed by insurance companies to determine the risk associated with insuring a particular driver and their vehicle. This analysis translates into the premium you pay.

Driving History

Your driving history is a primary factor influencing your car insurance rates. Insurance companies use this data to assess your risk profile. A clean driving record with no accidents or violations will typically result in lower premiums. Conversely, a history of accidents, traffic violations, or driving under the influence (DUI) can significantly increase your rates.

- Accidents: Even a single accident can lead to a substantial increase in your premium. The severity of the accident, your level of fault, and the number of claims you have filed all factor into the calculation.

- Traffic Violations: Speeding tickets, running red lights, and other traffic violations can also result in higher premiums. The severity of the violation and the frequency with which you have been cited will impact your rates.

- DUI: A DUI conviction can have the most significant impact on your insurance rates. Insurance companies view this as a serious risk factor and often impose substantial rate increases or even deny coverage.

Age and Gender

Age and gender are often considered in insurance rate calculations. Generally, younger drivers, especially those under 25, tend to have higher premiums due to their lack of experience and increased risk-taking behavior. Older drivers, on the other hand, may benefit from lower rates as they are statistically less likely to be involved in accidents.

- Age: Insurance companies often categorize drivers into age brackets, with each bracket reflecting a different risk profile. Younger drivers typically fall into higher-risk categories, leading to higher premiums.

- Gender: Historically, insurance companies have observed that men tend to have higher accident rates than women, leading to higher premiums for men in some cases. However, this practice is becoming increasingly scrutinized, and some states have banned gender-based pricing.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining your car insurance rates. Insurance companies consider factors like the vehicle’s make, model, year, safety features, and repair costs when calculating premiums.

- Make and Model: Some car models are known for their safety features and lower repair costs, which can lead to lower premiums. Conversely, vehicles with a history of frequent accidents or high repair costs may attract higher rates.

- Year: Newer vehicles typically have more advanced safety features and are less likely to be involved in accidents. This can result in lower premiums compared to older vehicles.

- Safety Features: Vehicles equipped with safety features like anti-lock brakes, airbags, and electronic stability control are often considered safer and may qualify for discounts.

- Repair Costs: Vehicles with high repair costs, especially those with expensive parts or complex repairs, can lead to higher premiums.

Credit Score

In many states, including Texas, insurance companies use credit scores as a factor in determining car insurance rates. A good credit score is often associated with responsible financial behavior, which insurance companies view as a proxy for responsible driving habits. A higher credit score can lead to lower premiums, while a lower score may result in higher rates.

- Credit Score as a Proxy: While credit scores are not a direct indicator of driving habits, insurance companies have found a correlation between good credit scores and lower accident rates.

- Fairness and Privacy: The use of credit scores in insurance pricing has been a subject of debate, with some arguing that it is unfair and invades privacy. However, insurance companies maintain that credit scores are a valuable tool for assessing risk.

Finding the Best Car Insurance in Houston

Finding the right car insurance in Houston can be a daunting task, given the multitude of options available. However, with a systematic approach, you can navigate the process effectively and secure a policy that meets your specific needs and budget.

Comparing Car Insurance Quotes

To find the best car insurance in Houston, it’s essential to compare quotes from multiple insurers. This allows you to evaluate coverage options, pricing, and customer service before making a decision.

- Online Comparison Tools: Websites like Policygenius, The Zebra, and Insurance.com allow you to enter your details and receive quotes from various insurers simultaneously. These tools are convenient and can save you significant time.

- Contacting Insurance Agents: Independent insurance agents work with multiple insurance companies, allowing them to offer you a wider range of options. They can also provide personalized advice based on your specific needs and circumstances.

- Requesting Quotes Directly from Insurers: You can also contact insurance companies directly to request quotes. This allows you to discuss your needs in detail and get a customized quote.

Negotiating Car Insurance Rates

Once you have gathered quotes, you can leverage your options to negotiate a better rate.

- Bundle Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Pay in Full: Some insurers offer discounts for paying your premium in full upfront.

- Ask About Discounts: Inquire about available discounts, such as good driver discounts, safe driving courses, and anti-theft devices.

- Shop Around Regularly: Car insurance rates can fluctuate over time, so it’s essential to shop around regularly to ensure you’re getting the best possible price.

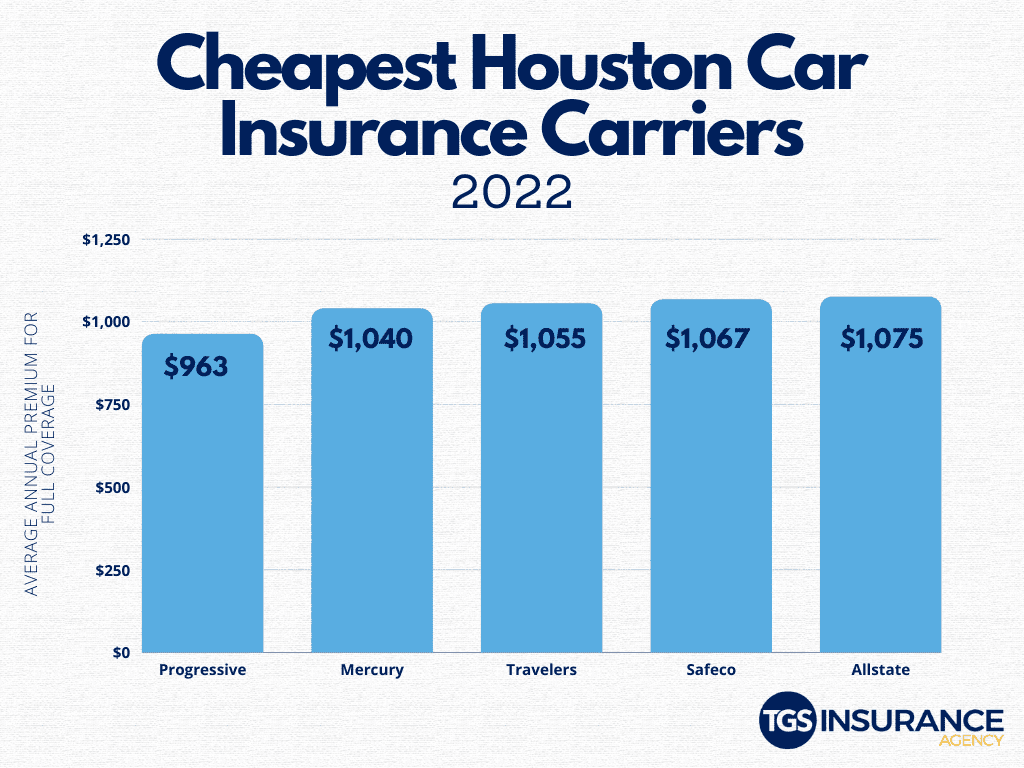

Top Car Insurance Providers in Houston

| Provider | Coverage Options | Customer Service | Pricing |

|---|---|---|---|

| State Farm | Comprehensive, Collision, Liability, Personal Injury Protection (PIP), Uninsured/Underinsured Motorist (UM/UIM) | 4.5/5 stars on Trustpilot | Competitive rates, discounts for bundling, good driver discounts |

| Geico | Comprehensive, Collision, Liability, PIP, UM/UIM | 4/5 stars on Trustpilot | Affordable rates, discounts for good drivers, military discounts |

| Progressive | Comprehensive, Collision, Liability, PIP, UM/UIM | 3.5/5 stars on Trustpilot | Wide range of coverage options, personalized pricing, discounts for bundling |

| Allstate | Comprehensive, Collision, Liability, PIP, UM/UIM | 4/5 stars on Trustpilot | Strong customer service, discounts for good drivers, accident forgiveness |

| USAA | Comprehensive, Collision, Liability, PIP, UM/UIM | 4.5/5 stars on Trustpilot | Excellent customer service, competitive rates, discounts for military personnel |

Car Insurance Claims Process in Houston

Navigating the car insurance claims process in Houston can feel overwhelming, especially after an accident. Understanding the steps involved, the roles of key players, and the different claim types can help you navigate this process smoothly.

Reporting an Accident

After an accident, it is crucial to report the incident to your insurance company promptly. This step initiates the claims process and allows your insurer to begin investigating the incident.

- Contact your insurance company: Immediately after the accident, call your insurance company to report the incident. Be prepared to provide details about the accident, including the date, time, location, and the parties involved.

- File a police report: In most cases, it is advisable to file a police report, especially if there are injuries or significant property damage. This report serves as official documentation of the accident.

- Gather evidence: Collect any relevant evidence at the scene, such as photographs of the damage, witness contact information, and any other documentation that supports your claim.

Gathering Evidence

After reporting the accident, your insurance company will likely request additional information and evidence to support your claim.

- Medical records: If you have sustained injuries, provide your insurance company with medical records documenting your treatment and expenses.

- Vehicle repair estimates: Obtain estimates from reputable repair shops for the cost of repairing your vehicle. These estimates should be detailed and include parts and labor costs.

- Witness statements: If you have witnesses to the accident, gather their contact information and statements. These statements can help support your version of events.

Submitting Documentation

Once you have gathered all necessary evidence, you will need to submit it to your insurance company.

- Claim form: Complete and submit a claim form provided by your insurance company. This form will request detailed information about the accident, your vehicle, and your injuries.

- Supporting documentation: Submit all supporting documentation, including police reports, medical records, vehicle repair estimates, and witness statements, along with the claim form.

- Follow up: After submitting your claim, follow up with your insurance company to ensure they have received all necessary documentation and to inquire about the status of your claim.

Role of Insurance Adjusters

Insurance adjusters play a crucial role in the claims process. They are responsible for investigating the accident, assessing the damage, and determining the amount of compensation to be paid.

- Investigating the claim: Adjusters will review the information you have provided and may conduct their own investigation, including inspecting the damaged vehicle and interviewing witnesses.

- Assessing the damage: Adjusters will assess the extent of the damage to your vehicle and determine the cost of repairs or replacement.

- Negotiating settlement: Adjusters will negotiate a settlement amount with you based on the terms of your insurance policy and the extent of your damages.

Timeline for Claim Processing

The time it takes to process a car insurance claim in Houston can vary depending on the complexity of the claim and the efficiency of your insurance company.

The average processing time for a car insurance claim in Houston is typically between 2 to 4 weeks.

- Simple claims: Simple claims involving minor damage and no injuries can be processed relatively quickly, often within a few days or weeks.

- Complex claims: Complex claims involving significant damage, injuries, or disputes can take longer to process, sometimes several months.

Types of Car Insurance Claims

There are different types of car insurance claims, each with its own specific process and requirements.

- Collision claims: These claims cover damage to your vehicle resulting from a collision with another vehicle or object. They are typically covered by collision coverage.

- Comprehensive claims: These claims cover damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. They are typically covered by comprehensive coverage.

- Liability claims: These claims involve claims against you for damages caused to another person or their property due to your negligence. They are typically covered by liability coverage.

Tips for Safe Driving in Houston

Navigating Houston’s bustling streets requires more than just knowing the routes. Safe driving in Houston necessitates an awareness of the city’s unique traffic patterns, weather conditions, and potential hazards. Understanding and applying defensive driving techniques, along with adhering to traffic laws, is crucial for minimizing risks and ensuring a safe journey.

Defensive Driving Techniques in Houston

Defensive driving involves anticipating potential hazards and taking proactive steps to avoid accidents. This proactive approach is particularly important in Houston, where heavy traffic, aggressive drivers, and unpredictable weather conditions can create challenging driving situations.

- Maintain a Safe Distance: In congested traffic, leaving ample space between your vehicle and the car in front is essential. This buffer allows you to react more effectively to sudden braking or changes in traffic flow.

- Be Aware of Surroundings: Always scan your surroundings, including mirrors and blind spots, to identify potential hazards like merging vehicles, pedestrians, or cyclists. This helps you anticipate and avoid collisions.

- Avoid Distractions: Distracted driving is a major contributor to accidents. Avoid using cell phones, texting, or engaging in other activities that take your attention away from the road.

- Be Prepared for Sudden Stops: Houston’s traffic can change abruptly, especially during rush hour or inclement weather. Maintain a safe speed and be ready to brake quickly if necessary.

- Yield to Emergency Vehicles: Emergency vehicles, such as ambulances and fire trucks, have the right of way. Pull over to the side of the road and allow them to pass safely.

Traffic Laws and Regulations in Houston

Houston’s traffic laws are designed to ensure the safety of all road users. Familiarizing yourself with these laws and adhering to them is essential for preventing accidents and avoiding penalties.

- Speed Limits: Observe posted speed limits. Speeding is a major cause of accidents and can result in fines and points on your driving record.

- Traffic Signals: Obey all traffic signals, including red lights, stop signs, and yield signs. Running a red light or failing to stop at a stop sign is a serious offense.

- Lane Usage: Stay in your designated lane and avoid changing lanes without signaling. Improper lane changes can lead to collisions.

- Parking Regulations: Adhere to parking restrictions, including no-parking zones and time limits. Illegal parking can result in fines or towing.

Avoiding Common Driving Hazards in Houston

Houston’s traffic environment presents a number of potential hazards. Being aware of these hazards and taking precautions can significantly reduce your risk of accidents.

- Aggressive Drivers: Houston is known for its aggressive drivers. Avoid engaging with these drivers, maintain a safe distance, and report any reckless behavior to the authorities.

- Distracted Driving: Distracted driving is a widespread problem in Houston. Avoid using cell phones, texting, or engaging in other activities that take your attention away from the road.

- Road Construction: Houston is a city under constant construction, which can lead to lane closures, detours, and other traffic disruptions. Be aware of construction zones, follow posted signs, and drive cautiously.

- Heavy Traffic: Houston’s traffic can be heavy, especially during rush hour. Plan your trips accordingly, allow extra time for travel, and avoid driving during peak hours if possible.

- Weather Conditions: Houston’s weather can be unpredictable, with heavy rain, thunderstorms, and even occasional tornadoes. Be aware of weather forecasts, adjust your driving speed accordingly, and avoid driving during severe weather events.

Car Insurance Resources in Houston

Navigating the complexities of car insurance in Houston can be overwhelming. Thankfully, several resources are available to assist individuals in finding the best coverage and understanding their rights as policyholders. These resources include government agencies, consumer advocacy groups, and online platforms that offer valuable information and support.

Government Agencies

Government agencies play a crucial role in regulating the insurance industry and protecting consumer interests. In Texas, the Texas Department of Insurance (TDI) is the primary regulatory body for car insurance.

- The TDI website provides comprehensive information on car insurance requirements, consumer rights, and complaint procedures. It also offers resources for finding licensed insurance agents and brokers in Houston.

- The TDI’s consumer hotline (1-800-252-3439) allows individuals to file complaints, ask questions, and receive assistance with insurance-related issues.

Consumer Advocacy Groups

Consumer advocacy groups provide independent and unbiased information about car insurance and advocate for consumer rights. These organizations can help individuals understand their policy options, negotiate with insurance companies, and file complaints when necessary.

- The Texas Department of Insurance has a consumer protection division that investigates complaints against insurance companies and advocates for policyholders’ rights.

- The National Association of Insurance Commissioners (NAIC) is a non-profit organization that works to protect consumers by promoting fair and transparent insurance practices. The NAIC website provides information on car insurance laws and regulations in all states, including Texas.

- The Better Business Bureau (BBB) offers information about insurance companies, including customer reviews and complaints. Individuals can use the BBB website to research different insurers and compare their ratings before making a decision.

Online Platforms

Online platforms have revolutionized the way individuals research and compare car insurance options. These platforms provide comprehensive information about different insurance companies, coverage options, and pricing. They also offer tools to compare quotes and find the best deals.

- Websites like Policygenius, Insurify, and QuoteWizard allow users to compare quotes from multiple insurers simultaneously, saving time and effort.

- These platforms also provide detailed information about different coverage options, allowing users to understand the nuances of each policy and choose the one that best suits their needs.

Insurance Agents and Brokers

Insurance agents and brokers act as intermediaries between individuals and insurance companies. They provide personalized advice and guidance, helping individuals understand their insurance needs and find suitable coverage.

- Insurance agents represent specific insurance companies and sell their products. They typically have extensive knowledge of their company’s offerings and can provide customized recommendations.

- Insurance brokers are independent and work with multiple insurance companies. They can compare quotes from different insurers and help individuals find the best coverage at the most competitive price.

- Working with an agent or broker can be beneficial for individuals who are unfamiliar with the complexities of car insurance or who need assistance navigating the insurance market.

Car Insurance Trends in Houston

Houston’s car insurance landscape is undergoing a transformation, driven by technological advancements and evolving consumer preferences. These shifts are impacting how insurance is priced, purchased, and experienced, with implications for both drivers and insurers.

Telematics and Usage-Based Insurance

Telematics technology, which uses devices to track driving behavior, is gaining traction in Houston. Usage-based insurance (UBI) programs leverage this data to personalize premiums based on individual driving habits. These programs offer potential benefits for safe drivers, as they can earn discounts for responsible driving practices.

- Lower Premiums for Safe Drivers: UBI programs analyze factors such as speed, braking, and time of day to assess risk. Safe drivers who demonstrate good driving habits can receive significant discounts on their premiums.

- Real-Time Feedback and Driving Insights: Telematics devices provide drivers with real-time feedback on their driving behavior, encouraging safer driving practices. This data can also offer valuable insights into driving patterns and potential areas for improvement.

- Increased Transparency and Control: UBI programs provide drivers with greater transparency into their driving habits and how they impact their insurance premiums. This empowers drivers to take control of their insurance costs by adopting safer driving practices.

Impact of Technological Advancements

The automotive industry’s rapid technological advancements are influencing car insurance trends in Houston. Advancements in autonomous driving, vehicle connectivity, and data analytics are creating new opportunities for insurers to develop innovative products and services.

- Autonomous Vehicles and Liability: The emergence of autonomous vehicles raises complex questions about liability in accidents. Insurers are adapting their coverage options to address these evolving risks, potentially leading to new types of insurance policies specifically designed for autonomous vehicles.

- Data-Driven Risk Assessment: Insurers are leveraging data analytics to develop more accurate risk assessments, leading to more personalized and equitable premiums. This data can include driving behavior, vehicle maintenance records, and even credit scores.

- Personalized Insurance Products: Technology enables insurers to offer customized insurance products tailored to individual needs and driving habits. This allows drivers to select coverage options that best align with their specific risks and preferences.

Car Insurance for Specific Needs in Houston

In Houston, a diverse and bustling metropolis, car insurance needs can vary significantly depending on individual circumstances. Whether you own a high-value vehicle, operate a commercial fleet, or have specialized driving requirements, finding the right insurance policy is crucial for adequate protection.

Car Insurance for High-Value Vehicles

Owning a luxury or high-performance car in Houston comes with unique insurance considerations. These vehicles often require specialized coverage to protect against potential financial losses in case of accidents, theft, or damage.

- Agreed Value Coverage: This coverage option allows you to determine the value of your vehicle at the time of purchase, ensuring you receive the full agreed-upon amount in case of a total loss, regardless of depreciation. This is particularly beneficial for high-value cars that depreciate rapidly.

- Enhanced Collision and Comprehensive Coverage: Higher limits on collision and comprehensive coverage are essential to cover repairs or replacement costs for expensive parts and labor associated with luxury vehicles.

- Specialized Parts Coverage: Some insurance providers offer coverage for specialized parts, such as custom paint, aftermarket modifications, or rare components, which may not be covered under standard policies.

Car Insurance for Commercial Vehicles

Commercial vehicle insurance in Houston caters to businesses that use vehicles for work purposes, including delivery trucks, taxis, and ride-sharing services.

- Commercial Auto Liability Coverage: This coverage protects your business from financial liability in case of accidents involving your commercial vehicles, covering injuries to others, property damage, and legal expenses.

- Commercial Auto Physical Damage Coverage: This coverage protects your business from financial losses due to damage to your commercial vehicles, including collisions, theft, vandalism, and natural disasters.

- Non-Owned Auto Liability Coverage: This coverage protects your business from liability if your employees use their personal vehicles for work purposes.

Car Insurance for Drivers with Specialized Requirements

In Houston, individuals with specific driving needs, such as those with medical conditions or driving for a living, may require specialized car insurance coverage.

- High-Risk Driver Coverage: Drivers with a history of accidents, traffic violations, or certain medical conditions may be considered high-risk and may need to seek coverage from specialized insurance providers who cater to this demographic.

- Ride-Sharing Coverage: Drivers who use their personal vehicles for ride-sharing services require specific coverage that extends beyond standard personal auto policies to cover potential liability and risks associated with transporting passengers for hire.

- Commercial Driver’s License (CDL) Coverage: Individuals who hold a CDL and operate commercial vehicles for work purposes need insurance policies specifically designed for commercial drivers, which include coverage for specific risks and legal requirements.

Car Insurance Coverage for Specific Risks in Houston

Houston’s unique geographical location and climate present specific risks that require tailored insurance coverage.

- Flood Damage Coverage: Houston is prone to flooding, making flood insurance crucial for protecting vehicles from water damage. While not typically included in standard auto policies, flood insurance can be purchased as an add-on.

- Hail Damage Coverage: Houston experiences frequent hailstorms, which can cause significant damage to vehicles. Comprehensive coverage typically includes hail damage, but it’s essential to ensure adequate coverage limits.

- Theft Coverage: Car theft is a concern in Houston, and comprehensive coverage typically includes theft protection. However, it’s important to review coverage limits and consider additional security measures to deter theft.

Examples of Tailored Car Insurance Policies

- High-Value Vehicle: A Houston resident owning a $100,000 sports car may opt for an agreed value policy, ensuring they receive the full purchase price in case of a total loss, regardless of depreciation. They may also choose to increase their collision and comprehensive coverage limits to cover expensive repairs or replacement costs for specialized parts.

- Commercial Vehicle: A Houston-based delivery company operating a fleet of trucks may need commercial auto liability coverage to protect the business from financial liability in case of accidents. They may also require commercial auto physical damage coverage to cover repair or replacement costs for their vehicles.

- Ride-Sharing Driver: A Houston resident who uses their personal vehicle for ride-sharing services may need ride-sharing coverage that extends beyond standard personal auto policies to cover potential liability and risks associated with transporting passengers for hire.

Ultimate Conclusion

In the dynamic landscape of Houston’s roadways, securing the right car insurance is more than just a legal obligation; it’s a strategic decision that can safeguard your financial well-being. By understanding the intricacies of coverage options, rate determinants, and the claims process, you can navigate the city’s streets with greater peace of mind. Remember, choosing the right car insurance isn’t a one-size-fits-all approach. By carefully evaluating your individual needs, you can find the policy that best aligns with your driving habits, vehicle type, and financial goals, ensuring a smooth and secure journey on Houston’s diverse roads.